Plan for Your Future during Financial Literacy Month

We celebrate Financial Literacy Month every April to promote financial education and well-being in the United States. Financial Literacy Month also serves as a reminder that Social Security is a vital part of any financial plan. Our online tools can help you understand your potential Social Security benefits and how they fit into your financial future.

You should periodically review your Social Security Statement (Statement) using your personal mySocial Security account at www.ssa.gov/myaccount. Your Statement is an easy-to-read summary of the estimated benefits you and your family could receive, including potential retirement, disability, and survivors’ benefits.

If you’re planning to retire, you can visit our Plan for Retirement webpage at www.ssa.gov/prepare/plan-retirement. Here you can compare how different future earnings and retirement benefit start-dates might affect your future benefit amount.

Please tell your friends and family about the steps they can take to improve their financial knowledge by exploring their personal mySocial Security account. If they don’t have an account, they can easily create one at www.ssa.gov/myaccount.

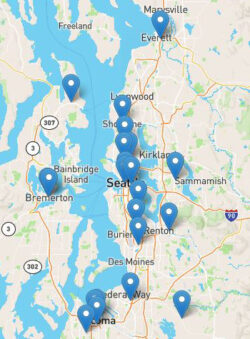

During Financial Literacy Month and throughout the year, you can learn more about personal financial management at the Washington State Department of Financial Institutions’ Financial Education for Washington Residents webpage as well as the resources listed below.

Contributor Kirk Larson is the Washington State Social Security Public Affairs Representative.

Financial Education and Wellness Services

The Senior Money Project highlights the urgent need to identify scams targeting older people and to help you make wise financial choices and protect yourself against fraud.

The Senior Money Project highlights the urgent need to identify scams targeting older people and to help you make wise financial choices and protect yourself against fraud.

Their Consumer Resources webpage includes valuable information about scams, home equity, reverse mortgages, estate planning, credit reports, Medicare and Medicaid, and credit loans.

The Senior Money Project is part of CENTS (Consumer Education and Training Services), which was developed by Western Washington financial professionals and attorneys, including representatives from the Northwest Justice Project, Federal Trade Commission, and the United States Bankruptcy Court.

![AgeWise King County [logo]](https://www.agewisekingcounty.org/wp-content/themes/agewisekingcounty/images/logo.png)